Herd Value Scheme

Inland Revenue have recently announced this year’s livestock Herd Scheme Values and we think this is a great opportunity to update you on the latest movements.

The Herd Scheme Values are the National Average Market Values, determined by a process involving a review of the livestock market as at 30 April.

The values for Dairy this year have seen a fall in values across all female classes, but increases across all male classes. The fall in R1 heifer values can be attributed to the prohibition of live export by sea commencing from 30 April 2023. For the first time the National Average Market Value for R1 Heifers is less than the National Standard Cost of breeding and rearing an R1 Heifer.

A Mixed Age Dairy cow now has a National Average Market Value of $1,628 compared to $1,697 last year – a fall of 4.1%. Rising one and two-year heifers have decreased in value by 14.3% and 2.4%, to $693 and $1,436 respectively.

Whilst demand for dairy products remains relatively strong worldwide, it is expected that the farm gate milk price for the 2023-24 season will be well down from the highs of 2022-23, which will have a consequential impact on dairy cow values. The forecast reduction in the farm gate milk price together with continued inflationary pressures for all farm input costs will see dairy farmers’ profit margins diminish significantly for the 2024 season. This is likely to see demand for dairy cattle fall.

There continues to be little progress in relation to on-farm emissions reporting which leaves a dark cloud over the prospects of New Zealand’s largest export earner.

Availability of labour remains a significant issue for the 2024 season even though most immigration settings have been relaxed. Total cow numbers have continued to fall, as did per cow production mainly due to climatic reasons and are back to 2019-20 levels.

In contrast to Dairy values Beef values have increased on average 9% and are almost at record values for all classes.

This is very much a tale of two halves of the 2022-23 season as exports and prices were weak in the first half of the season but have improved substantially as the season has progressed mainly due to the global supply of beef being very tight.

As with 2022, meat works continue to struggle to keep up with processing demand as employee absence due to Covid-19 continues. This has put pressure on farmers who have suffered from unfavourable climatic conditions being unable to realise the best price for their cattle.

Uncertainty continues to play a part in the domestic market as the regulatory requirements around water quality, fencing and carbon continue to come into force in the coming years and alternative proteins continue to increase in popularity and use.

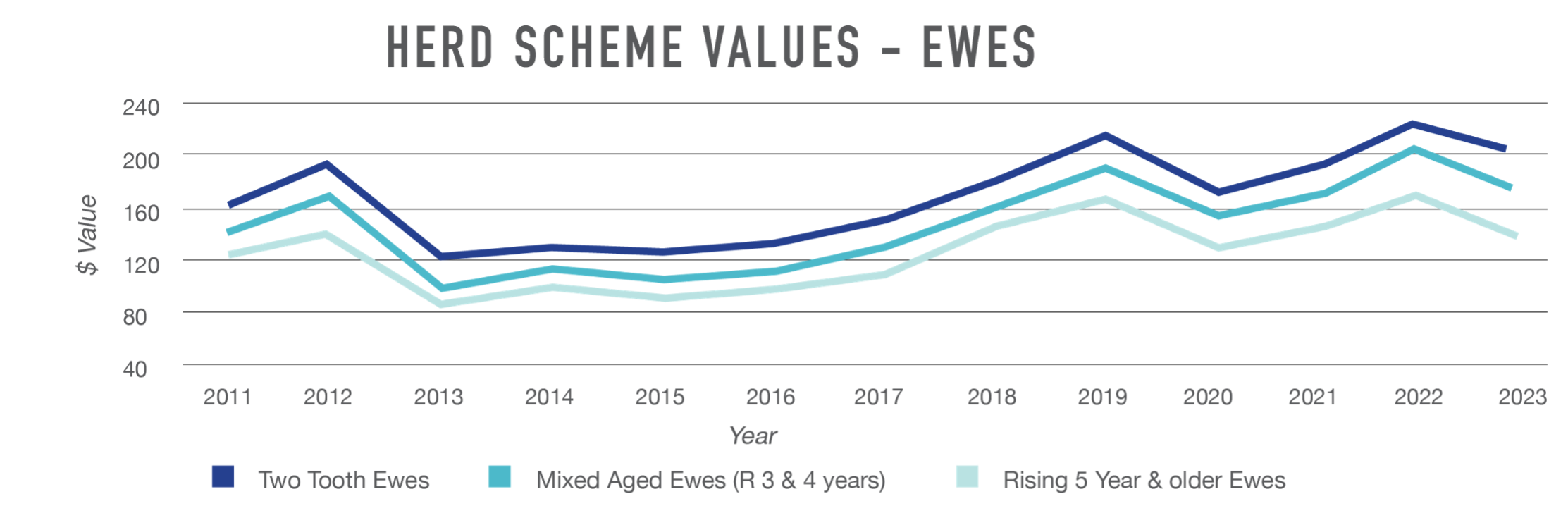

Sheep values have all fallen from the high of 2022, slipping back an average of 10.2%. Whilst values have fallen, they are still either the second or third highest that they have ever been depending on which class of sheep you are looking at.

The price of sheep meat weakened from the record highs of 2021-22 season and optimism from industry leaders for the 2023 season was largely unfounded in the first half of the year, although prices have seen a recovery and global supply remains limited which are keeping prices above historical averages.

Wool markets remain uncertain with forecast prices closely matching this season. Increased shearing costs continue to make wool uneconomic except at the fine end of the market.

Goat values have increased on average 7.8% with almost all classes of fibre and meat producing goats at record highs. The value of milking goats continues to be well down from historic highs, except for breeding bucks which are at their highest value. Female milking goats have continued their decline, down a further 3.7% this year for a 28.3% drop since 2021. 2023 values are less than half the highest value for female milking goats. The value of female breeding goats continues to be impacted by the collapse in milk solid returns in 2022 and associated reductions in quote entitlement, penalties for exceeding quota, and supply changes.

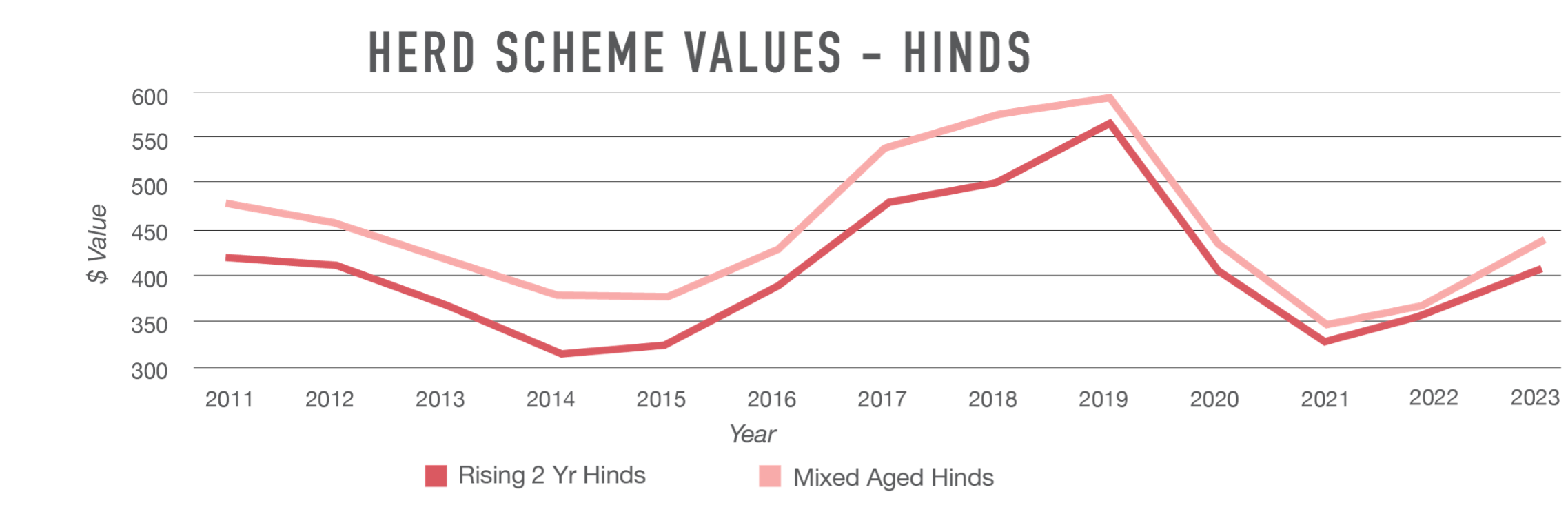

Deer values saw further recovery from the low values of 2021 with an average 16% increase in values for Red Deer, Wapiti, and related breeds. The market for velvet has also contributed to an increase in values and there is optimism that the lows of Covid-19 have passed and the export demand for venison continues to strengthen.

Other deer breeds have, on average, fallen back from the gains made in 2022. The market information for other breeds is limited with the value being influenced by the hunting and trophy trade which was significantly impacted by Covid-19. Values will likely recover further as trophy tourism returns to pre-Covid levels.